Unlock the Potential of Private Market Investments

I’m Sushee Perumal, a registered dealing representative with Rethink & Diversify Securities Inc., which has raised over $300 million for various businesses.Private Market investments have transformed my life as both an entrepreneur and an investor.Now, as a registered dealing representative with Rethink & Diversify Securities Inc. I’m here to offer investment opportunities that diversify your investment portfolio while fueling the ambitions of entrepreneurs who offer these investments.

What are your investment goals?

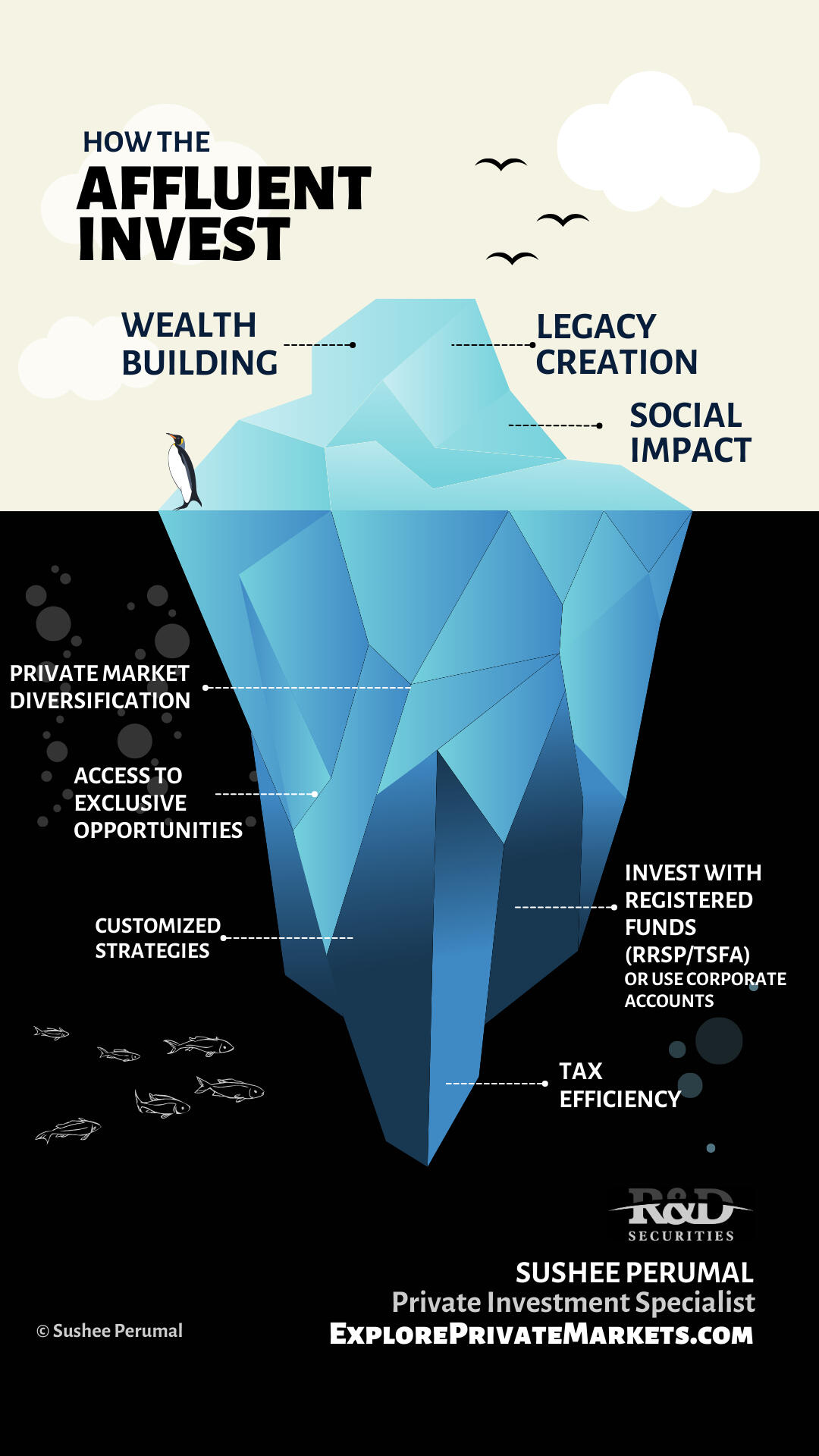

I sought a middle ground between the volatility of Public Markets and the low returns of GICs, leading me to discover Private Market investments. True diversification and robust portfolios extend beyond Public Markets, which is why the affluent and even pension funds consistently turn to Private Markets, utilizing alternative investments and tax strategies.

Why Consider Private Market Investments?

It's important to review the applicable offering memorandum or term sheet in detail before investing to ensure you understand the risks as outlined.

Diversification

Looking to diversify beyond the volatility of public markets? Even when diversified stocks and mutual funds remain susceptible to market swings. Private markets offer an additional layer of diversification, favored by the affluent and pension funds. As with any investment, it's crucial to understand the associated risks.

Income

Looking to have your money work harder for you? Some private investments aim for 8.5% to over 12% annualized returns, paid monthly or quarterly. Be aware that the investment income is not guaranteed.

Defer Taxes

Looking to defer income taxes on investment payouts? Certain private funds can provide additional income without the extra tax burden, often through a T5013 tax slip. Always understand the associated risks with investing.

Tax Reduction

Looking to reduce taxes on your current income? Alongside RRSPs, some private investments offer "flow-throughs" for tax reduction. It's important to note that not all tax reduction strategies may be suitable for every investor.

Target Returns

Looking for risk adjusted higher annualized targeted returns? Some private market funds target higher returns than what's available in the public markets. Note that the higher returns come with higher risks.

Registered Funds

Looking to invest with registered funds (RRSP/TFSA) or directly from your corporate account? Put your registered funds to work in private markets. With the higher risks, this might not be suitable for every investor.

Diversified Sectors

Looking to participate in sectors such as apartment buildings, agriculture, mortgages, private lending, etc.? Adding these sectors can diversify your portfolio. However, it's crucial to understand the associated risks as with any investment.

Some of the Private Market Opportunities Available

All of the securities are sold through Rethink & Diversify Securities Inc., an Exempt Market Dealer in BC, AB, SK, MB, ON, QC, NS, NB and PEI. Please contact me should you need information on any of the below.

Note that these products are not suitable for everyone.

Antrim

Mortgage Investment Corporation

7.5% Target Annual Return

- Quarterly Distribution

- Daily Liquidity

- $1,000 Minimum Investment

- RRSP/TSFA Fund Eligible

- Accredited / Eligible / Non- Accredited

- Contact Me to Learn More

- Webinar

Limestone Loan

Private Lending

- 8.5%-10.5% Target Annual Return

- Quarterly Distribution

- 3-5 Year Target Period

- $25,000 Minimum Investment

- RRSP/TSFA Fund Eligible

- Accredited Investors Only

- Contact Me to Learn More

HOLMES Trust

Commercial Real Estate

- 8% Target Annual Return (plus Profit Share)

- Monthly Distribution

- 5 Year Target Period

- $500 Minimum Investment

- RRSP/TSFA Fund Eligible

- Target Tax Advantages

- Accredited / Eligible

- Contact Me to Learn More

AP Capital MIC

Mortgage Investment Corp.

- 8.5% Target Annual Return

- Monthly Distribution

- 4 Year Target Period

- $10,000 Minimum Investment

- RRSP/TSFA Fund Eligible

- Accredited / Eligible / Non- Accredited

- Contact Me to Learn More

- Webinar

Crystal Creek Homes Inc.

Real Estate Development

- 8%-10% Preferred + 20%-30% Profit Share OR 12% Monthly

- Monthly Distribution

- 24-30 months target period

- $25,000 Minimum Investment

- Accredited

- Contact Me to Learn More

Millennium III

Real Estate Development

- Tax Treatment Deduction

- Target Return 16.16%

- Annual Distribution

- 24-30 months target period

- $24,700 Minimum Investment

- Accredited

- Contact Me to Learn More

Pier 4

Residential Apartments

- 12%-15% Target Annual Return (8% Target Annual Distribution)

- Monthly Distribution

- 3 Year Target Period

- $10,000 Minimum Investment

- RRSP/TSFA Fund Eligible

- Accredited / Eligible / Non- Accredited

- Contact Me to Learn More

- Webinar

Secure Capital

Mortgage Investment Corporation

- 8% Target Annual Return

- Monthly Distribution

- 1 Year Target Period

- $5,000 Minimum Investment

- RRSP/TSFA Fund Eligible

- Accredited / Eligible / Non- Accredited

- Contact Me to Learn More

- Webinar

FarmCap

Agricultural Land

- 10-12% Target Annual Return

- 3 Year Target Period

- Target Distribution at End

- $500 Minimum Investment

- Target Tax Advantages

- Accredited / Eligible / Non- Accredited

- Contact Me to Learn More

- Webinar

Equiton

Residential Apartments

- 8%-12% Target Annual Return

- Monthly Distribution

- 3 Year Target Period

- $10,000 Minimum Investment

- RRSP/TSFA Fund Eligible

- Accredited / Eligible / Non- Accredited

- Contact Me to Learn More

Centurion Apartment REIT

Real Estate Investment Trust

- 4.08% Cash / 4.25% Target Distribution with 7-12% Target Return

- Cap. Gains Tax Treatment

- Monthly Distribution

- 3 Year Target Period

- $25,000 Minimum Investment

- RRSP/TSFA Fund Eligible

- Accredited / Eligible / Non- Accredited

About me

Sushee Perumal

I grew a business from a $50,000 initial investment to $34 million in sales, expanding across 30+ cities in North America.As the business scaled, I needed financing but found that most options weren’t founder-friendly. Now, through Private Market placements, I’m helping entrepreneurs secure founder-friendly investments while enabling investors to invest like the affluent.Additionally, I do not take custody of funds—investments go directly to the companies I represent. Any fees I earn are paid by the company.

Book a 30-Minute Meeting...

or get in touch...

Thank you

I will be in touch!

Webinars

Antrim MIC (Mortgage Investment Corporation)

Secure Capital MIC (Mortgage Investment Corporation)

Pier 4 REIT (Real Estate Investment Trust) Webinar

AP Capital MIC (Mortgage Investment Corporation) Webinar

Antrim Mortgage Investment Corporation

Webinar on Antrim MIC

Secure Capital Mortgage Investment Corporation

Webinar on Secure Capital MIC

AP Capital Real Estate Fund

Webinar on AP Capital

FarmCap - Agriculture Fund

Webinar on FarmCap

Tax Savings through Flow-Through Funds

Webinar on Probity

Webinar

I will be in touch!

Rethink & Diversify Securities Inc.("R&D") is registered as an Exempt Market Dealer in BC, AB, SK, MB, ON, QC, NS, NB and PEI. R&D provides private investment opportunities to qualifying Canadians through a network of trained, registered Private Market Specialists throughout the country. This information does not constitute the sale or purchase of securities. This is not an offering of securities. Offerings are made pursuant to an offering memorandum and only available to qualified investors in jurisdictions of Canada who meet certain eligibility or minimum purchase requirements. The risks of investing are outlined and detailed in the applicable offering memorandum and you must review the offering memorandum in detail prior to investing. Investments are not guaranteed or insured and the value of the investments may fluctuate.

Glossary

Accredited investor (AI) - Sophisticated investors who do not require the protection of prospectus-type disclosure, including high net worth individuals.- An individual who, alone or with a spouse, beneficially owns, directly or indirectly, net financial assets with a realizable value exceeding $1 million or has net assets of at least $5 million, or

- An individual whose net income before taxes exceeded $200,000 (or $300,000 when including the spouse’s income) in each of the two most recent calendar years and who expects to exceed that net income level in the current calendar year.Asset allocation - Asset allocation is how an investor divides their portfolios among different assets such as equities, fixed‑income, and cash and its equivalents.AUM - Assets under management (AUM) is the market value of the investments managed by a person or entity on behalf of clients.Capital gains - A capital gain refers to the increase in the value of an investment when it is sold.Dealer Representative (DR) - Under securities legislation, every firm and individual must be registered if they are in the business of offering or advising in securities. In order to conduct business in private investment products, you must first become registered as a Dealing Representative with the securities regulator(s) in the jurisdiction(s) you want to conduct business in.Distributions- A distribution also refers to a company’s payment of stock, cash, and other payments made to its securities holders.Diversification - An investment portfolio management strategy that aims to reduce risk by investing in a variety of investments.DRIP - The word DRIP is an acronym for “distribution reinvestment plan,” which allows for the automatic reinvestment of cash distributions into additional securities of the investment.Eligible Investor - An individual whose:- Net assets, alone or with a spouse, exceed $400,000, or

Net income before taxes exceeded $75,000 in each of the two most recent calendar years and who reasonably expects to exceed that income level in the current calendar year, or

- Net income before taxes, alone or with a spouse, exceeded $125,000 in each of the two most recent calendar years and who reasonably expects to exceed that income level in the current calendar year.Exempt market - A marketplace for private investment securities.Exempt market dealer - Registered firm who sells exempt market securities to investors.Flow-through shares - Securities issued by companies that enable the initial purchaser tax benefits provided the company used the proceeds of the issuance in accordance with certain government requirements.GP/LP structure - A GP refers to the General Partner who is responsible for managing the partnership. LP stands for Limited Partners or Limited Partnership, consisting of investors who provide funds for the business without having responsibility to manage the partnership. LP’s have limited liability.KYC - Know Your Client (KYC) is a requirement whereby the Dealing Representative understands the client’s full situation including, but not limited to, their financial profile, identity, life situation, investment knowledge, etc.Issuers - An issuer is a legal entity that develops, registers, and sells securities to finance its operations. Issuers may be corporations, investment trusts, limited partnerships, or mortgage investment corporations. Issuers are legally responsible for the obligations of the issue and for reporting financial conditions, material developments, and any other operational activities as required by the regulations of their jurisdictions.NAV - Net Asset Value is the net value of an investment fund’s assets less its liabilities.Non-eligible investor - An investor who is neither an accredited investor nor an eligible investor.Offering - An issue or sale of a security by a company. An offering is also known as a securities offering.OM - An offering memorandum is a legal document that states the objectives, risks, and terms of an investment involved with a private placement. This document includes items such as a company’s financial statements, management biographies, a detailed description of the business operations, and more. An offering memorandum serves to provide buyers with information on the offering and to protect the sellers from the liability associated with selling unregistered securities.Private placement - Private placement is where a company issues securities to private investors rather than publicly on the open market.Products on the shelf - A colloquial term for all of the issuers that are currently raising capital and are available through Rethink & Diversify Securities Inc.Sources: IFSE Institute, pdac.ca, scotiatrade.com, td.com, ca.practicallaw.thomsonreuters.

com, ciro.ca, securities-administrators.ca, Investopedia.com, getsmarteraboutmoney.ca,

georgeedube.comDisclaimer: The definitions provided herein are not legal definitions and do not constitute

advice. They are layman’s term definitions o assist you in understanding the presentations

at the Invest it Right conference. To obtain the legal definitions please refer to the

Securities Act, R.S.O. 1990, c. S.5 for Ontario. If you reside in a different

jurisdiction, please refer to the Securities Act associated with the applicable jurisdiction(s)

Investments Overview

Get by eMail: How the Affluent Invest